Sunday, June 21, 2009

If health care were the post office.

1) Fed Ex and UPS would be donating millions to congressthings, who

2) Would be all up in our teevee's telling us that the goverment is so incompetent there's no way it would run a good service, which

3) would unfairly compete with our private sector delivery firms and drive them out of business!!!!11!!, which is socialism, and would be EXTRA terrible because

4) It would lead to government bureaucrats between you and mail to your loved ones!

And the TV people would nod and agree that these were very serious points, and anyone who suggested that a government post office might run well would simply not be invited to appear on the tube. And if someone suggested that for 65 cents the government would pick a letter up at your door, and the drop it off, absolutely reliably all the way across the country 3 days later, they would be laughed at out loud, because everyone KNOWS that the gov is always incompetent, the sky is blue, grass is green, the earth is flat, and Newt Gingrich is a highly reputable font of high quality ideas.

Thursday, April 23, 2009

some patriarchal caveats

Two caveats. Having watched a few more old movies, patriarchy clearly WAS an excellent term for North America 40 years ago. Women weren't supposed to work, were supposed to obey husbands, had to stay in their place, the whole 9 yards.

These days I think sexism has mostly just blurred into a general miasma of resentment of others.

The other caveat is supplied by right wing uber douche John Ziegler. As witnessed here.

He wants to date "someone who is... rational, which I realize is an oxymoron for a woman... [But] ideally you'd find someone with a manageable degree of irrationality. You're probably going to conclude that this is somehow mysogynistic but it's not."

It takes a special kind of person to say "I don't hate women, I'm just saying they're crazy."

This idea brought to you by the same people who thought up "I don't hate black people, but I can't help they're all criminals!" Funnily enough, not one of them has yet been spotted saying "I don't hate white guys, even though they're just all arrogant asshats with penis issues." I don't know, it's a mystery.

Is it torture?

Here's the question for conservatives:

If an American soldier was captured, would you be fine with him being beaten, slapped, slammed against a wall by a towel tied around his neck, waterboarded repeatedly, kept in a box not much bigger than a coffin with insects or rodents or snakes or whatever else he's phobic of.... after having been kept up for days at a time, shackled in stress positions, practically hanging from the ceiling?... If you're willing to visualize your crew-cut blue-eyed GI Joe having all that done to him, and you're willing to say "meh, fair game..." if you're willing to imagine your own brother being captured and having this all done to him (go ahead, imagine it), and you still insist that it's not torture... then congratulations, you're an asshole.

Sunday, April 19, 2009

The finance crisis as explained for the benefit of 16 year olds

Maria is pressing her young beau Tony ("Tony the Stereotype" to his friends) to make good in life, become bona fide, and bring home some bacon (bacon bits, minimum). Tony figures he only has one useful skill, so decides he's gonna open up "Tony's Caah Shop." He figures he can make an ok living at that, only problem is that he needs a shop first... which means he needs to rent some space on Main Street, buy a car lifter, get some new wrenches, hire a pretty young receptionist whom Maria will hate... call it $40,000. But Tony only has $14.52 and a half tube of Bryll Cream to his name. He looks under both couches for spare change but still comes up 35 grand short.

So Tony goes to the bank, talks a good game to Michael the branch manager, reminds him that Mikey still owes him from that one time in Junior High. He gets a $30 grand loan, sets up his shop, and fixes a lot of cars, and in due time pays the damn thing off. Life is good, and he is now tha man, with all the bacon, fries, and cold brews he ever wanted.

Fast forward, oh, 30 years.

Tony is now his town's car repair magnate, with as much lite beer at his beck and call as Jane (wife number two) won't let him drink ("you're getting fat." "No I ain't" "Yes you are." Rinse repeat, repeat).

But the car repair business ain't what it used to be, as all the new cars have too many computers in them to be easily fixable... But ol' Anthony is a man o' the times (at least, when Janey pushes him hard enough to be), and comes up with a new better plan. He's going to convert people's cars from gas to electricity. Unfortunately, if he's going to convert enough cars for this to work out, he'll need more wrenches. A lot more wrenches. And some big machines. When he does the math on this (and Tony Jr. fixes the mistakes in it), he basically needs a small factory. Which costs, oh, let's call it 40 million bucks.

So Tony goes back to Michael the banker for another loan. "April first was last week." Mikey says. "Pull the other one. Forty million bucks, what are you thinking?" No amount of arm twisting is going to get this kind of risk past Mikey's bosses. But there's an answer. Tony's Caah Caanversion can get individual investors to give him the money instead of just one bank. An investor forks over, say, a grand, and Tony gives them an IOU (i.e., a "bond") that he'll get them back for twelve hundred bucks in two years. Sell enough "bonds" and he can get his 40 million, build his factory, and start rolling in the sales revenue to pay off all the bonds and their fixed amounts of interest. Play it right and he'll need fork lifts to get all his bacon back home.

In fact, Mikey the banker thinks he might buy himself some of Tony's bonds. He may only be a lowly branch manager, but by dint of living in a tiny apartment, and subsisting entirely on Ramen Noodles and Kraft Dinner (he's from Canada) he's managed to put Mikey Jr through college and still save up $30 grand. He figures a savings account would only pay him 1%, or so, but he could buy ten of Tony's bonds for $10 grand, and in two years he'd get back $12 grand. Boom boom boom, two thou new friends, just like that.

But Tony isn't the only person out there selling bonds. So is IBM. So Mikey thinks about this some. The problem with Tony's bonds, is what if the factory doesn't work, or the cars don't sell, and his operation goes belly up? If Tony goes out of business then Mikey doesn't get ANY of his nest egg back, he's just lost 10 grand. And let's face it, Tony is a good guy, but does he have it in him to run a whole factory? On the other hand, he's pretty sure IBM will still be there even five years from now, so it seems like a slam dunk to buy the IBM bonds instead. Or it would be, except IBM knows that Mikey knows that they'll still be there in two years. In short, IBM knows that Mikey likes their stability, so they know they don't have to sweeten the pot much to get him to bite. So their IOU bond offers only $1100 in two years, not $1200 like Tony's. So what's a wannabe investor to do? How can he (or she) figure out EXACTLY how likely it is for Tony and IBM to snuff it in the next year?

This is where credit rating agencies come in. These are companies like Moody's, and Standard and Poor. Their whole gig is to look at company's like Tony's and IBM, and judge what the exact chance is that they'll be able to pay back their bonds down the road. They work out what the percent chance is, and then, because some investors are afraid of numbers, they turn it into a pretty letter grade like AAA or A- or B+. And they're pretty good at it, having been doing this for a hundred years and change. The riskier they say that your company is, the more you're going to have to offer as a return on your bonds if you want anyone to give you money for them. If IBM is an AAA rated company, their bonds are considered as good as money. If they say they'll pay you $1100 in 2 years, then darn it you're going to get your cash. If they say Tony is a B+, then they're letting you know that he's probably good for it, but you're definitely taking your chances.

Now let's move a little further up the food chain. Mikey Jr.'s dad didn't just put him through any old college, he finagled him into Harvard. And nobody ever really fails out of the Ivy League once they are enrolled, so Mikey Jr. graduated and was hired by an investment bank. Unlike dad, he spends all day every day toying with stocks and bonds and similar.

When you're a bank you've got two types of clients. One type gives you money to look after, and the other type you loan money out to. Having these two types of clients is basically what makes you a bank. So in that first column, there's the pension fund that Tony set up for his employees. He pays a bunch of cash in now, and expects to get it back with some interest when his employees retire so they can afford properly negligent and abusive hospice care. So Mikey Jr has that money to look after. This is where his other type of client comes in. He can check out businesses, and lend to them if he likes whatever project they need cash to get going, demanding a big payback down the road. Or, if he doesn't want to do all the work checking this company out himself, he can ditch the boring world of savings and loan banking and just start buying bonds from these companies based on what Moody's says. And the best part of this is that if he has a bond that pays back $1500 in 5 years but he needs the money now, he doesn't wait, he can sell it for $800, and whoever buys it can be the one to sit around and wait for the big payout. He just needs to sit at his little computer, and he can buy and sell bonds all day.

From his point of view, buying a bond is just giving someone some money now in return for getting more money later, and a mortgage is exactly the same thing. You give someone money to buy a house now, and then they pay you back in little drabs every month for the next 30 years. Cash goes out now, and (more) cash comes in later.

But then Mikey can get even smarter still. Why bother holding on to all those bonds and mortgages when he can just sell them (for a fee naturally) to the pension fund, and THEY can hold on to the suckers themselves? But there's a problem here. Lots of pension funds, and other such organizations don't want to buy mortgages because they're too risky. Last thing they want is to buy up a bunch of mortgages (meaning they pay someone for the privilege of receiving all the monthly payments that will be made on it in future) and then have a bunch of those houses default on them (as home owners are wont to do), and then they have nothing for their people to retire on. A lot of these funds have explicit rules saying things like "we only buy things rated A+ or better."... but mortgages aren't rated by credit agencies. And even if they were, they wouldn't be rated that high.

Here comes the game changing wrinkle. This is the bit that this whole story has been leading up to. This is the big idea. What some overly smart person realized is that while any given mortgage (or bond, or whatever) might go bankrupt and default on you, if you take a whole bunch of them and pipe the incoming money into one bucket, then the bucket might not end up fill all the way up as high as it should if EVERYONE paid, but it's certainly not going to end up empty either. SOME of those payments are bound to work out. So here's the clever plan: You take this bucket into which all the mortgages are paying, and you label the bottom third of it the "senior tranche." That means that when it's time to empty the bucket, people who have bought rights to the bottom third get first dibs on whatever is there, and they are pretty much guaranteed to be in luck. Then you can call the middle third the "mezzanine tranche" and the top third the "junior tranche." If you buy the junior tranche, you're only getting paid back if enough mortgages paid in enough cash for the bucket to get filled up high enough. The junior tranche therefore sells pretty cheap. The senior tranche OTOH will cost you. It's like buying IBM's bond instead of Tony's, you pretty much KNOW it's coming through.

And when Tony Jr. takes a bunch of bonds or mortgages (or bonds or whatever) and does this, he has now "structured" them into a "structured investment vehicle." In this case, specifically, it would be a "collateralized debt obligation" (yep, the CDO's we hear so much about).

And what is so great about doing this? Well, those rating agencies who wouldn't touch mortgages were fine with putting AAA ratings on those super safe senior tranche's, and when those tranches have AAA ratings, pension plans and mutual funds and suchlike are now comfortable buying them. Tony Jr. has put himself on the gravy train.

But what does he do with those middle and junior tranche's? They are kinda risky because heaven knows SOMEONE is likely to default. But not to worry, another smart banker figured he could just pull the same trick all over again, and roll a whole bunch of junior tranche's into a new bucket, and label that new bucket with it's own tranches. So the senior tranche in this new CDO bucket (a CDO2 if you will) gets first dibs on whatever money comes through from the bottom tranches of the original CDO's, and so on. And the innovative free market jumped all over these new opportunities with alacrity, pumping more and more money into these wildly profitable "instruments." And yea, did business ever boom.

Now in the bad old days a bank would give you a mortgage, and then live off the money that you paid them for the next 30 years. That meant banks didn't want to give you a mortgage if they didn't have a pretty shrewd idea you were going to pay it back. But with the advent of CDO's they didn't have to do that anymore. They could make a mortgage, and then turn around and sell the rights to the mortgage payments to someone else, take their cut, and wash there hands of it. Most banks would try and sell their mortgages to the quasi-government organizations Fannie Mae (FM) and Freddie Mac (also FM). But the FM's had standards. They wouldn't buy up a loan unless it was made to someone with a job and a respectable credit rating. But a few private investors would buy up loans that the FM's would turn their nose up at. These 'sub prime' loans were pretty dicey of course, but the magic of structuring them into a CDO made a whole lot of that risk go away. After all, even if half of them defaulted, your senior tranche was going to be basically ok.

And these CDO's became big big business, to the point that more money was being spent on trading them back and forth than was going into building the factories, and other "real world" activities that all of this was supposed to be supporting. And to feed this market, a bunch of private sellers got into real estate, writing mortgages as fast as they could talk people into buying a shiny new house. And who cared if these people even had any money down, an income, or a credit history, just so long as they could be signed up for a mortgage that could be packaged into a CDO and sold on to some investor. And the junior levels of these dicey dicey CDO's? Well, just roll a bunh of 'em into a CDO2 and you can sell them for even more. And, of course, all this extra house buying meant there weren't enough houses to go around for all the people who wanted them, so the prices went up and up and up... which, of course, made real estate look like a fabulous investment ("prices have gone up 30% in 3 years!"), so people got into buying houses just for the rising values... This is what economists call a "bubble." Bubbles have two properties. They inflate, and they pop.

Now here's another wrinkle on the wrinkle on the wrinkle: Credit rating agencies normally consider companies separately when they rate them. Odds of them going bankrupt may fluctuate up or down with the business cycle, but the credit rating companies just give you the long term outlook, regardless of what other company's are doing. And for investors who are just buying stocks and bonds from individual companies, this is fine. But the thing about these CDO's is that for them it really DOES matter if something bad happens to the other mortgages feeding into the same bucket. If you bought from the middle level of a bucket, you might not care if any one of the mortgages goes bad, but you do care a whole lot if they all go bad at once. You only get paid if enough money pours into the buckt that it fills up to your level. But the odds of a whole lot of mortgages independently folding up are small, right? Like, it's possible to flip a coin and get 40 heads in a row, but surely it's a pretty safe bet that it won't.

But let's say those houses are all in the same town, and lets say that the factory closes which used to employ most of the people in that town. All of a sudden you really do have almost all those mortgages defaulting at the exact same time. Rating agencies didn't really think about this much, because they weren't used to considering systematic risk. Or what happens if the economy suddenly goes into a recession...

Now let's put these two things together. One, we've got people buying stakes in buckets of money that are filled up as mortgage payments pour into them. Two, we have a housing bubble where prices go up and up in a self-sustaining cycle... which makes people want to give mortgages to anybody possible so they can package the mortgages into a CDO bucket, which makes the price go up even more. Oh, and did I mention that income for middle class earners had been stagnant for a decade (thanks Dubya!), so families were piling on debt, and taking out second mortgages (now rebraded as "home equity loans," which sound way less threatening, right?) just to maintain their standard of living... So, all of those mortgages feeding into those CDO buckets weren't really as independent as rating agencies assumed them to be (as they assume about everything).

So... when people finally got to the point that they wouldn't pay any more for houses, the prices stopped going up. And that meant that all the people speculating in real estate lost money. So they stopped trying to flip houses. And then there weren't enough real actual home buyers to keep prices up at their astronomic levels. So house prices went down and when that happened, lots of homeowners found themselves with freshly bought houses on which they owed considerably more than they could ever get by selling it (they were "upside down" in finance speak). So a lot of them walked out and defaulted on their mortgage payments, and all of a sudden, the cash flowing into those CDO buckets suddenly slowed to a trickle. People holding mid level CDO tranches, who had thought that it was almost impossible for so many people to default at once, found themselves looking ashen faced at their books, wondering what just happened.

And it was even worse for people holding a CDO2, because even the "senior" tranches were made up of the left-overs from the bottom levels of groups of other CDO's... and the bottom level of all those CDO's were disappearing wholesale. Which was bad news for sub-prime assets, and bad news for pension plans and middle class guys like Mikey who had bought in to them to provide income to retire on.

And banks, who had taken in lots of people's money, with promises to pay more of it back later found that a lot of the money that they had been holding as nice profitable CDO's was now pretty much worthless. These are the "toxic assets" we hear so much about. It's not that they're toxic per se (really, a bank could throw them out their window tomorrow, if they wanted, and pretend they never saw them before), it's that they took the money they were supposed to be looking after and bought magic beans that stopped being magic, and now they don't have the cash to pay out what they owe. As the old saying goes, "it takes money to make money." A bank without money is therefore in a whole world of hurt.

And now we're at the end of the story. But before you go read that Harvard report (which hopefully you're now even better positioned to understand), there's one last question to consider. Why were these CDO's so overpriced?

Well part of it was that credit agencies were only used to considering companies in isolation, and weren't very good at considering systematic risk, like we just discussed. According to these Harvard guys' simulations they only had to be a little bit wrong about how much the odds of one mortgage defaulting were related to the odds of other mortgages defaulting (or bonds or whatever) for the predicted default rates to go badly wrong (especially for the CDO2's).

But another part was because nobody had really thought through how even the top tranches would be affected by recessions. Imagine you're Mikey Jr., and you're buying stocks and bonds. When the economy does well, you do well, and when it does badly you take a hit. But what you really want is for your wealth to grow steadily, rather than shooting up and crashing down all the time.

So what you really want to find are a couple of stocks that might not grow as fast in the good times, but that are pretty immune to recessions - maybe beer companies, or movie theaters (people need to escape from bad times, right). If a stock move the opposite way most other stocks move, then it's a valuable one to have, because it smooths out the peaks and crashes in your portfolio (in finance jargon, it's a hedge, because it hedges your bets). But CDO's are the opposite. They are pretty much guaranteed to do well when the economy as a whole is doing well (because companies don't default on their bonds, and people don't default on mortgages when it's easy to make sales and get hired). But they reliably run into a whole lot of problems when the economy does badly (companies run out of cash to pay bonds all at the same time, people get kicked out of their houses en masse). That should make CDO's less attractive to own, but because people just hadn't thought this through (CDO's hadn't been invented last time there was a really big crash - or at least, they weren't widespread then). This lack of thought helped hype up the market into a bigger bubble full of enthusiasm wild success--the pop from which is still hurting us.

Congratulations, on reading all the way to the end here. You have earned the fabulous prize of late-onset myopia :)

Monday, February 16, 2009

Proven disasters shouldn't get half the joystick

Right wing America: The land where eight years of unmitigated failure and disaster means: "Well thank heavens we, and our wisdom, was in charge."

Sunday, February 15, 2009

I declare this post hereby en-titled.

Although it would be fun to start an entitlement program by which all registered Republicans are rounded up an thrown in prison. What, do they think they're just entitled to walk around wherever they like?

On a related note, their religion may say that gays shouldn't be allowed to get married, but mine says that Republicans belong in jail. If we are obliged to allow their religion to be freely enforced by the state, then so should mine be too.

Saturday, February 7, 2009

What if you played Monopoly and the game never ended?

That's a lot like real life, except here bankruptcy doesn't mean you now have time to grab a new bag of chips from the basement, it means you are at risk of becoming a street person. Also, the game Monopoly has to end when one person owns all the property, because nobody has any more money to pay them anything. But real life doesn't end. Instead, the winners keep sucking in wealth, trickle out a little charity, and hand to their kids ownership of the railroads and Park Avenue. This, historically, is how it's worked (see Robbers, Baron). And this is what libertarians and neo-cons don't understand. The best bit of the game is the middle bit, where everyone is the most engaged, and there is real space for eventual winners to move up.

It took us till the 20th century to figure out is how to make real life Monopoly keep on working. You need a government that progressively skims people's wealth as they get richer, and which takes a fat cut out of what they pass to their kids. Obviously you don't take everyone to zero, but the trick is to keep the game in its middle stages where there are winners and losers, but people are close enough that they can move from one to the other. That's where the action is, that's where the vigor is, that's where the liveliness is.

And hey, now you can use the tax money to help people, and to invest in things like education and research that aren't profitable in the short term, but that level the playing fields in the medium term, and pay off for everyone in the long term. It's win win win win.

Tuesday, February 3, 2009

More than you ever wanted to know about The Boss

... one of them reported: "Bruce Springsteen just tea bagged all of America."

Ah, poetry.

Saturday, January 31, 2009

The enemy of their enemy makes discharge come out of people's whozits

Or perhaps it just hasn't occurred to them that spending money on fighting these things involves paying people to do their jobs, which involves putting money in the pockets of potential consumers, which enables consumption, which feeds retailers, which will help minimize the recession... and once this realization takes over their pro-business instincts will kick in and they'll get behind the measure. Or maybe not?

Friday, January 30, 2009

How not to make friends with the modern feminist movement

For one thing it's focused entirely on gender, but what about the other kinds of prejudice? Like 80 years ago it would be fair to say we were in a WASPiarchy, but these days jews aren't really resented in most of North America, and Irish and Italian Americans are no longer (by the bizarre logic of prejudice-land) "races" so much as flavors of whiteness. Plus there's a shifting miasma of other prejudices. Depending where you are there's a smartiarchy or a dumyarchy, and there is an omnipresent and exceptionally powerful cooliarchy (tied in heavily, but not exclusively, to the beautiarchy).

I'm not trying to be glib here - Gender based prejudice is almost certainly the most common form of prejudice in terms of raw frequency of occurrence, and leads to lots of Really Bad Things. The set of stats I found in a quick google search had Black men making a slightly higher median income than white women at all levels of education - though they were reasonably close, and both dwarfed by White men's income (1995 stats makes it slightly old data). And of course, the statistics on rape are just mind-bogglingly evil. But I don't think it's easy to compare suffering side by side. Women are at a far higher risk of being raped, Blacks are at a far higher risk of being imprisoned... I don't think you can even start to contemplate questions like: "how many years in jail would you trade for being raped once". It simply defies humanity to do so. Suffering on this kind of scale is just horrible wherever it is found. And it's not just gender and race. People with mental disorders, for example, can suffer social stigmas that put them at elevated risks of alcoholism and suicide, and poor people are basically screwed every which way to Sunday (especially in the States where they get lousy health care, if any at all). So we're living in a patri-whity-neurotypic-wealthiarchy for starters.

On a more philosophical note, as Wikipedia puts it "The English suffix -archy (from Greek αρχή, rule) denotes leadership and government." Prejudice certainly can be codified into, and enforced by government (see Crow, Jim) but most modern prejudice has little to nothing to do with government, and very little to do with leadership either. In fact, a lot of it takes place at non-conscious levels, merely shaping expectancies rather than directing commandments at people - and people's level of prejudiced actions (at least the non-overt modern kinds) seems to ebb and flow with their level of insecurity. That's not a governing principle, it's people just being shitty to each other when they're feeling defensive.

That isn't to say that prejudice doesn't shape society - the types of roles people get shunted in to, and how easy it is for them to flourish there matter (see the enormous wage disparities). And anything that encourages or excuses aggression can lead to physical assaults and their coverups. But that doesn't make it an "archy: any more than other strong social force are. People feel compelled to surround themselves with other people and have friends, and will massively rearange their worlds to get it, indeed will put up with massive amounts of abuse to get it, but we don't live in a sociarchy do we? Really?

Playing the game so hard you forget to win?

The House has passed the stimulus bill with not a single Republican vote.Aren’t you glad that Obama watered it down and added ineffective tax cuts, so as to win bipartisan support?

Ok, but my understanding is that it still has to get through the senate, right. So it's not like the Dems could have just written ANYTHING they liked and zipped it through. Just because mom isn't paying attention doesn't mean you can get away with anything when it still has to get past dad (although it seems odd to be casting R's as the parental figures here, when a whole lot of them seem more intent on behaving like spoiled 12 year olds).

Plus some people smarter than me (e.g.,) argue that Barrack is playing the long-term optics here - he gets to come back and say: "we offer them compromise after compromise, and consultation after consultation, and STILL they don't even try to support the results."

Though, I guess at some point you have to stop playing politics for gain and using the gain that you've already bought... it's a tricky thing, no.

Thursday, January 29, 2009

Solving the myseries of life, one doo doo analogy at a time.

The House does not cast a secret ballot. It seems plausible that there were a dozen or so Republicans who were on the fence, waiting to see how their colleagues would vote --- and when those votes started to come in unanimously against the bill, nobody wanted to be the ugly ducking.In other words, there was a lot of normative pressure not to, perhaps even some pluralistic ignorance by which the congrescritters all assumed they were the only one who didn't object... But you do sometimes get small numbers of Republicans voting against their party. As Nate himself points out, a few days ago 3 of 178 Republicans voted for the Ledbetter Fair Pay Act.

I saw a Republican congress guy on teevee last night when I was at the gym, and his claim was that the house R leadership told a bunch of their members to vote for the old TARP bank bailout, and were roundly ignored. This time the leadership just took their cue from anti-stimulus sentiment of the general membership, and agreed to say 'no'.

My guess is that the Republicans have had a creeping awareness for some time now that their brand was in serious doo doo, and when the doo doo hit the fan during the last election, they realized that they are up to their necks in it, and their world is a big frightening smelly place. They are now desperately huddling together, clinging white-knuckled to whatever vestiges of ideology they think might have any legs whatsoever with the general public, and "fiscal conservative" is all they've got. And so they are going to pull it out from under all the doo doo, and place it on their personal alter of political expediency and pray to it, with all the weak-kneed fervour they can muster. And the first item of business for them to pray for is that nobody notices the horrible slurping sound that comes from anything so well buried being pulled out from under that much doo doo, because if people realize that "fiscal conservatism" is something the republicans only really care about when the Dems are in power, then the doo doo might close in completely over their heads.

Of course, one of Nate's commentors has a wittier take:

Groucho Marx: From the 1932 movie "Horse Feathers"

"I'm Against it"

Music and Lyrics By: Bert Kalmar and Harry Ruby

Song Lyrics:

[Groucho]

I don't know what they have to say,

It makes no difference anyway,

Whatever it is, I'm against it.

No matter what it is or who commenced it,

I'm against it.

Your proposition may be good,

But let's have one thing understood,

Whatever it is, I'm against it.

And even when you've changed it or condensed it,

I'm against it.

I'm opposed to it,

On general principle, I'm opposed to it.

[chorus] He's opposed to it.

In fact, indeed, that he's opposed to it!

[Groucho]

For months before my son was born,

I used to yell from night to morn,

Whatever it is, I'm against it.

And I've kept yelling since I first commenced it,

I'm against it!

--

UPDATE: It seems someone at ObWi is thinking down the same lines as me. Thought they do so with a total absence of scatological analogy. Disturbing, no?

Academics are supposed to be the impractical ones, why are business leaders being the self-defeating idiots?

Here's why that's particularly stupid (recession edition): the problem is NOT that companies don't have enough money to build factories with. It's not like people are going to the mall and saying "I'm so frustrated, I just can't find enough things to buy. Won't somebody please give industry more cash so they can invent more products".

The problem is that consumers are looking at all the stuff on sale, and shrugging it all off because they can't *afford* any of it right now. Give more money to the inventors, and they're not going to risk it on R&D for big new products, not in this economy. Give it to banks, and they will sit on it, because they figure anyone they lend it to will just lose it anyway. Give it to rich people, and maybe they'll invest some of it (i.e., give it to banks and inventors, who will duly sit on it), or they'll stick it under THEIR mattress themselves.

What we need to do is to spend money building railroads, laying grass in parks, paying young people to be rangers for the summer... something, anything, to get cash into the pockets of ordinary Americans (particularly poor ones, who are pretty much guaranteed to go out and spend it post haste) so that they can go out and be consumers again. If American business leaders could remove their heads from their own behinds for just a minute they would see that lack of consumers is a far bigger problem than lack of investors right now, and they would get solidly behind heavy-spending stimulus bills, rather than trying to block them like they are.

Normally, business faces a collective active problem over wages - it is in their interest to pay their own employees as little as possible, while hoping that everyone else pays their employees generously, so that those employees have the money to buy the company's goods and services. But that constraint isn't even here now - if the money comes from the governments, why are the corporations so opposed? Answer: toxic ideology and stunning myopia.

The self-image of choice for business people is traditionally of a square shouldered, granite jawed colossus standing astride the flows of commerce, in a sharp suit. Okay, but lets add to that picture a Mr. Magoo squint, and two inch thick glasses. Now imagine he's just dropped the glasses. That's about right.

--

Update: Krugman says something similar, but in more technical terms.

"conservative" means you're supposed to want things to be consitent, right?

Fifty-three percent of American voters voted for Barack Obama; 46% voted for John McCain, and 1% voted for wackos. Give that 1% to President Obama. Let’s say the vote was 54% to 46%. As a way to bring the country together and at the same time determine the most effective way to deal with recessions, under the Obama-Limbaugh Stimulus Plan of 2009: 54% of the $900 billion—$486 billion—will be spent on infrastructure and pork as defined by Mr. Obama and the Democrats; 46%—$414 billion—will be directed toward tax cuts, as determined by me.

Yeah, because this is exactly how the Republicans governed. Bush got 51% of the vote, Gore got 49%, so Bush said "well, that means we get half the policies I want, and half the ones you want. I want to declare war in Iraq and drop taxes enormously on rich people. Name 2 policies of your own, or just pick one of mine and we'll nix it"

I assume that rush made this suggestion because he is a good bible readin' Christian (after all, Jesus was always talking about hypocrites, and why would he do such a thing if he didn't want us to BE hypocrites).

Corporations: Delivering value to nation state clients for 300 years

Sometimes you don't have to make up analogies, the world just hands them to you.

Thursday, January 22, 2009

Bush the not so stupid?

I think the reality is that he's a marginally bright guy (maybe even brighter than average), but he was put in charge of a very very very complicated thing. I think he did his best with it, but in the words of a novel I read once "he was like a competent Ford mechanic with a Ferrari on his hands." Except really he tended to screw up the normal businesses he ran too, so maybe it would be better to say that he was a competent bicycle mechanic with a Ferrari on his hands.

"Well I got the gas going to the cylinder tubes. That's what you gotta do right, a engine can't fire if you don't got the gas going to the tubes. Anyway, I did my best with it, history will have to be the judge. Heh heh."

And there's nothing wrong with being a bike mechanic. I like to tinker with them myself, but if you've got a beaten up stealth bomber that needs some work, I suggest you find someone else. And that, RIGHT THERE, is what makes me smarter than Bush.

Wednesday, January 21, 2009

Congratulations America

Welcome back. It's been too long. You have no idea how much we missed you.

Tuesday, January 20, 2009

Kristol

"Barack Obama is not going to beat Hillary Clinton in a single democratic primary. I'll predict that right now."Minor correction there Bill: PRESIDENT Obama is not going to beat Hillary Clinton in a single democratic primary. Sorry, you were saying?

h/t huffpo.

Sunday, January 18, 2009

more videos

h/t noIQ.

Saturday, January 17, 2009

eh

but here's a pretty interesting video to keep the life support machine on this blog for the now

Thursday, January 8, 2009

Problems with survey design

Do you think Jeb Bush will seek the presidency? Y/N

and

Would you vote for Jeb Bush for president? Y/N

you can go there and vote. The problem is, they don't give the any of the right answers (for the record, respectively: "Dunno." and "Not ever EVER EVAR in a bazillion years if you torture me with rhino grade cattle prods. Unless, maybe, it was a choice between him and dubya. But all else equal there I'd take the cattle prods")

Wednesday, January 7, 2009

Holy Jiminiy God on a stick.

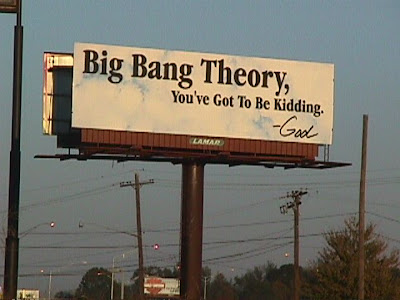

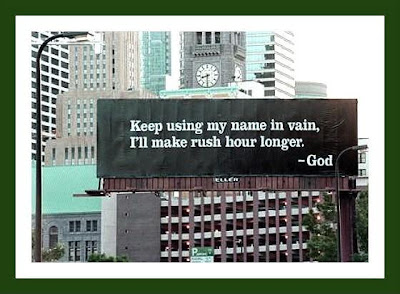

“I think it’s dreadful,” said Sandra Lafaire, 76, a tourist from Los Angeles, who said she believed in God and still enjoyed her life, thank you very much. “Everyone is entitled to their opinion, but I don’t like it in my face.”To be fair, they're far classier in America:

Though also, sometimes, funnier:

source.